A Short Review Of Refinance Car Loans

Today, a number of banks, monetary establishments and lenders are current in the market that offer easy access to automobile mortgage schemes, making car loans easy to obtain.Thus, a person can now purchase a automotive of his personal even when he's operating wanting ample money or assets.While searching for automotive loans, it is important to explore all potential options to decide on upon a deal that gives the lowest interest rates and greatest repayment options.Careful examine of all factors concerned in auto loan finance might help an applicant achieve this. An important side to be considered while dealing with auto loans is the credit score rating of the applicant.People with unhealthy credit histories are seen as a significant danger by most banks and monetary institutions, and therefore they face difficulties in obtaining appropriate auto loans.Such of us can't avail of lowest fee auto loan.Some dealers in the market supply dangerous credit score auto loans. What most individuals don’t know is that refinance car loan schemes are additionally available in the market.Refinance car mortgage scheme implied that the current auto loan could be repaid by the applicant utilizing another loan from a distinct lender, at significantly decrease curiosity rates.Thus, vital interest and total repayment is lowered with the help of car loan refinancing.Applicants who've improved their credit score score and can obtain lowest price auto loan ought to undoubtedly avail of refinance car loan schemes.This may assist them full repayment quickly with lowered curiosity charges.

Today, a number of banks, monetary establishments and lenders are current in the market that offer easy access to automobile mortgage schemes, making car loans easy to obtain.Thus, a person can now purchase a automotive of his personal even when he's operating wanting ample money or assets.While searching for automotive loans, it is important to explore all potential options to decide on upon a deal that gives the lowest interest rates and greatest repayment options.Careful examine of all factors concerned in auto loan finance might help an applicant achieve this. An important side to be considered while dealing with auto loans is the credit score rating of the applicant.People with unhealthy credit histories are seen as a significant danger by most banks and monetary institutions, and therefore they face difficulties in obtaining appropriate auto loans.Such of us can't avail of lowest fee auto loan.Some dealers in the market supply dangerous credit score auto loans. What most individuals don’t know is that refinance car loan schemes are additionally available in the market.Refinance car mortgage scheme implied that the current auto loan could be repaid by the applicant utilizing another loan from a distinct lender, at significantly decrease curiosity rates.Thus, vital interest and total repayment is lowered with the help of car loan refinancing.Applicants who've improved their credit score score and can obtain lowest price auto loan ought to undoubtedly avail of refinance car loan schemes.This may assist them full repayment quickly with lowered curiosity charges.

Td Auto Finance

This content was written with the help of GSA Content Generator Demov ersi on .

The purple herring prospectus is so named because of a daring purple warning statement printed on its entrance cowl. The warning states that the providing info is incomplete, and may be changed. The actual wording can range, though most roughly observe the format exhibited on the Facebook IPO pink herring. Throughout the quiet period, the shares cannot be provided on the market. Brokers can, nevertheless, take indications of interest from their shoppers. At the time of the inventory launch, after the Registration Statement has grow to be effective, indications of interest could be converted to buy orders, at the discretion of the purchaser. Sales can solely be made by way of a remaining prospectus cleared by the Securities and Exchange Commission. The ultimate step in getting ready and filing the ultimate IPO prospectus is for the issuer to retain considered one of the foremost monetary "printers", who print (and right this moment, also electronically file with the SEC) the registration assertion on Form S-1.

Financial historians Richard Sylla and Robert E. Wright have proven that before 1860 most early U.S.Multinational IPOs might have many syndicates to deal with differing authorized requirements in both the issuer's home market and other regions. For example, an issuer based mostly in the E.U. Europe, along with separate group corporations or selling them for US/Canada and Asia. Usually, the lead underwriter in the pinnacle promoting group can also be the lead financial institution in the opposite promoting groups. Due to the broad array of legal requirements and since it is an costly course of, IPOs also usually involve a number of regulation firms with main practices in securities regulation, such because the Magic Circle firms of London and the white-shoe firms of latest York City. Financial historians Richard Sylla and Robert E. Wright have proven that before 1860 most early U.S. In this sense, it is similar as the fixed value public offers that have been the standard IPO methodology in most non-US international locations in the early 1990s. The DPO eradicated the company problem related to offerings intermediated by funding banks.

10 Issues Everyone Is aware of About Corporate Finance That You don'tOne version of the Dutch public sale is OpenIPO, which relies on an auction system designed by economist William Vickrey. This auction technique ranks bids from highest to lowest, then accepts the highest bids that allow all shares to be bought, with all successful bidders paying the identical price. It is much like the mannequin used to public sale Treasury bills, notes, and bonds since the nineteen nineties. Before this, Treasury bills had been auctioned by a discriminatory or pay-what-you-bid auction, through which the assorted winning bidders every paid the worth (or yield) they bid, and thus the assorted successful bidders didn't all pay the same price. Both discriminatory and uniform price or "Dutch" auctions have been used for IPOs in lots of countries, although only uniform worth auctions have been used to date in the US. Large IPO auctions embrace Japan Tobacco, Singapore Telecom, BAA Plc and Google (ordered by measurement of proceeds).

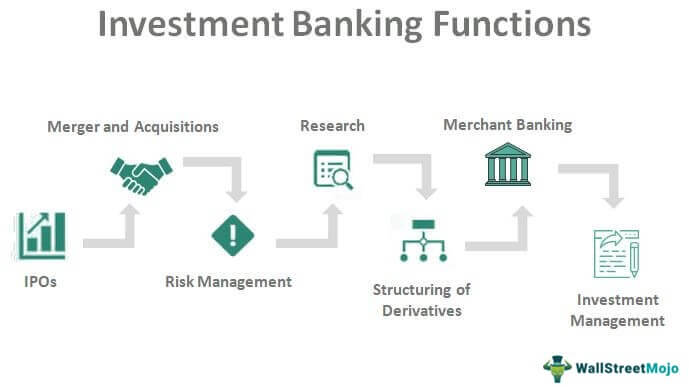

How Vital is Investment Banking. 10 Knowledgeable Quotes

This con te nt was g ener ated by GSA Content Genera tor DE MO!

This con te nt was g ener ated by GSA Content Genera tor DE MO!

Although IPO offers many advantages, there are also vital costs concerned, mainly those associated with the process similar to banking and legal charges, and the ongoing requirement to disclose necessary and generally delicate information. Details of the proposed providing are disclosed to potential purchasers in the form of a lengthy document often called a prospectus. Most corporations undertake an IPO with the assistance of an investment banking firm performing in the capability of an underwriter. Underwriters present several services, including help with accurately assessing the worth of shares (share price) and establishing a public marketplace for shares (initial sale). Alternative strategies such because the Dutch public sale have additionally been explored and utilized for several IPOs. The earliest type of a company which issued public shares was the case of the publicani throughout the Roman Republic, though this declare will not be shared by all modern scholars. Like modern joint-stock firms, the publicani were authorized bodies impartial of their members whose possession was divided into shares, or partes.