The Way to Quit your Investment Banking Job with Out Getting Executed

Clean Breaker was working at a middle-market funding bank, and acquired a suggestion to move to the corporate finance department of a Fortune 500 firm, a few months after bonuses had been awarded. He also hated his life (discover a typical theme here?), mostly as a result of one VP he labored for could greatest be described as “evil incarnate.” He was extremely out-of-shape, had no life exterior work, no mates, and spent all day making his analysts and associates miserable. Although Clean Breaker was miserable, he wasn’t foolish - so he didn’t inform a single soul that he was even interviewing until he had the signed supply in hand. “Trips to the dentist” and “personal days” are plausible when you don’t use them each single week. When the time came, he went on to his MD first and advised him the information, then informed Evil VP and the remainder of his staff. Result: Clean Breaker most likely can’t get a recommendation from his VP, but there’s nothing he might have completed to stop that. But since he dealt with it professionally, he may easily return to his MD and ask for help sooner or later.

Td Auto FinanceThis content was gen erated with GSA Conten t Generator DEMO!

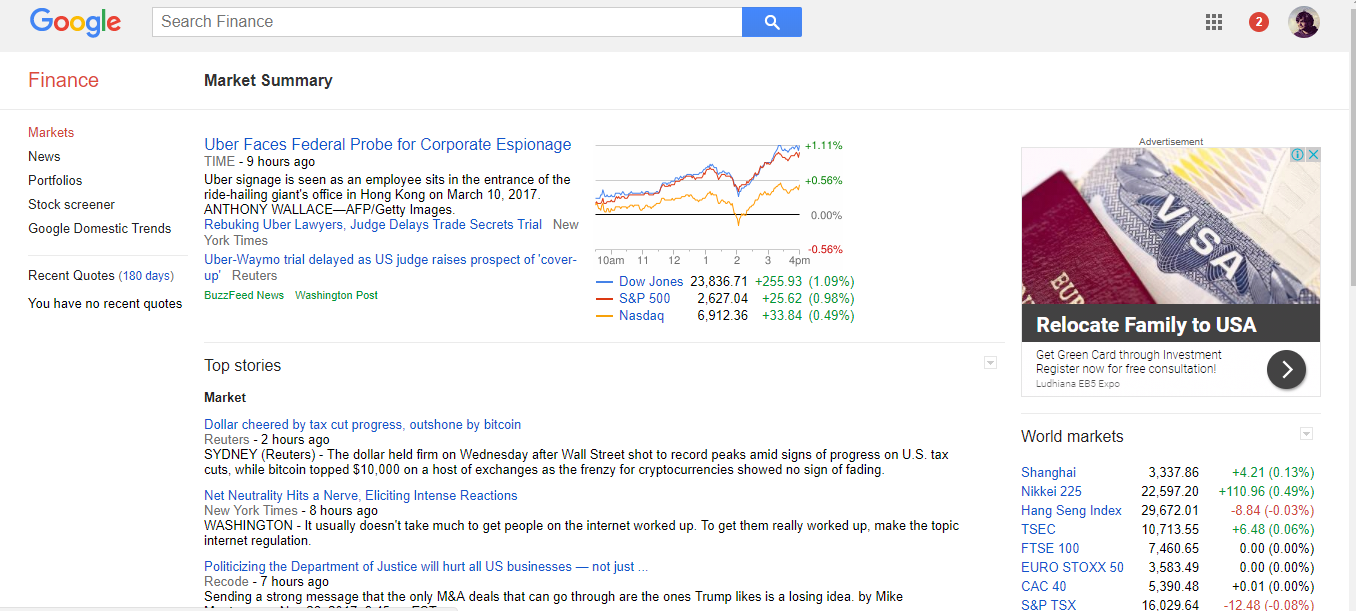

10 Methods To Have (A) More Appealing Finance Google

Don't get emotional or give into any calls for or last-minute requests. You’re quitting. For those who say “no” to these demands, what will they do? Saying “yes” won’t put you on better phrases, both - if they make last-minute demands of you, they wouldn’t write a very good recommendation in the first place. Once you’ve informed your MD, go round and say the identical thing to your other staff members, retaining it brief and unemotional. Then, relying on whether you have got to leave immediately or you could have a few days to a week, go and craft a brief farewell electronic mail along with your new contact information. Don’t send this out to the whole investment banking department or the whole financial institution - you’re not that vital. Just send it to your individual group, or to anybody you’ve labored with up to now. Much like a tale of two summer interns, a quick tale of two quitting analysts will illustrate simply how essential the above factors are.

Don't get emotional or give into any calls for or last-minute requests. You’re quitting. For those who say “no” to these demands, what will they do? Saying “yes” won’t put you on better phrases, both - if they make last-minute demands of you, they wouldn’t write a very good recommendation in the first place. Once you’ve informed your MD, go round and say the identical thing to your other staff members, retaining it brief and unemotional. Then, relying on whether you have got to leave immediately or you could have a few days to a week, go and craft a brief farewell electronic mail along with your new contact information. Don’t send this out to the whole investment banking department or the whole financial institution - you’re not that vital. Just send it to your individual group, or to anybody you’ve labored with up to now. Much like a tale of two summer interns, a quick tale of two quitting analysts will illustrate simply how essential the above factors are.

But I feel it can be crucial that the UK can venture a monetary system that's solid. In a note titled “promises made, promises kept”, Ian Gordon at Investec praised the bank, noting “stubborn, persistent outperformance towards market expectations”, and the tenth profitable quarter in a row. Richard Hunter at interactive investor mentioned: “Barclays has provided a glimmer of hope to what has been a turbulent time for the banks. Barclays notes that it granted 640,000 payment holidays to prospects and waived £100 million of charges. Staley added: “There is quite a lot of economic pain out there and we shouldn’t underestimate that. But I take coronary heart that we are able to run a bank of this complexity with 55,000 sitting at house. Barclays whole provision for bad debts stand at £4.3 billion. That group “impairment charge” for the yr thus far was up from a comparatively minor £1.4 billion final time. And it includes a £700 million write down for a mortgage to a “single name” company consumer.

Barclays kicked off financial institution reporting season at the moment with results that shattered City expectations, providing hope that the financial fallout from Covid is manageable and that shareholders may quickly reap rewards. The financial institution made revenue in the final three months of £1.1 billion, more than twice what analysts had pencilled in. It put aside £608 million for bad debts, far lower than anticipated, and the investment banking arm some buyers needed CEO Jes Staley to scrap is booming. That might imply chunky banker bonuses, relying on the regulator and the bank’s sensitivity to the general public mood. This was the best quarter of the 12 months so far, with finance director Tushar Morzaria noting that the financial institution “continues to take market share from the Americans”, a reference to its rivals on Wall Street. The investment financial institution noticed revenues up 24% to £9.8 billion. Barclays plainly feels it is powerful enough to pay dividends. Staley informed the usual: “We have bought to look forward to the year to complete.

Barclays kicked off financial institution reporting season at the moment with results that shattered City expectations, providing hope that the financial fallout from Covid is manageable and that shareholders may quickly reap rewards. The financial institution made revenue in the final three months of £1.1 billion, more than twice what analysts had pencilled in. It put aside £608 million for bad debts, far lower than anticipated, and the investment banking arm some buyers needed CEO Jes Staley to scrap is booming. That might imply chunky banker bonuses, relying on the regulator and the bank’s sensitivity to the general public mood. This was the best quarter of the 12 months so far, with finance director Tushar Morzaria noting that the financial institution “continues to take market share from the Americans”, a reference to its rivals on Wall Street. The investment financial institution noticed revenues up 24% to £9.8 billion. Barclays plainly feels it is powerful enough to pay dividends. Staley informed the usual: “We have bought to look forward to the year to complete.