Finance? It's Easy Should you Do It Smart

LONDON, Nov 22 (Reuters) - Europe's largest fund supervisor Amundi has downgraded one hundred funds with 45 billion euros ($46.28 billion) in assets to a decrease level of sustainability beneath European Union rules ahead of new reporting requirements going reside in January. The transfer comes as regulators take a harder line on funds' environmental, social and governance (ESG) credentials amid considerations that traders might be misled. The move comes ahead of Jan. 1, when asset managers can be required to outline their sustainability targets and claims within the fund documentation that is sent to clients. Since initially classifying the funds, some regulators like the France's AMF seemed set to adopt a harder stance on what an Article 9 fund ought to look like, said Jean-Jacques Barberis, Head of Institutional and company Clients Coverage and ESG at Amundi. Amundi stated in an announcement it was taking a "deliberately cautious strategy" in the face of evolving regulation, adding that its choice did not call into query "the sustainability traits of those funds". Amundi's move is part of an expected wave of downgrades of Article 9 funds as investors look to pre-empt higher regulatory scrutiny, the manager of a global fixed revenue fund told Reuters.

Td Auto Finance

A mortgage-backed security (MBS) is a kind of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and bought to a group of people (a government company or investment financial institution) that securitizes, or packages, the loans together right into a safety that buyers should buy. The construction of the MBS may be referred to as "cross-through", the place the curiosity and principal funds from the borrower or homebuyer go by it to the MBS holder, or it may be more advanced, made up of a pool of other MBSs. Other sorts of MBS embody collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt obligations (CDOs). A mortgage bond is a bond backed by a pool of mortgages on a real estate asset similar to a home. More typically, bonds that are secured by the pledge of specific assets are called mortgage bonds.

A mortgage-backed security (MBS) is a kind of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and bought to a group of people (a government company or investment financial institution) that securitizes, or packages, the loans together right into a safety that buyers should buy. The construction of the MBS may be referred to as "cross-through", the place the curiosity and principal funds from the borrower or homebuyer go by it to the MBS holder, or it may be more advanced, made up of a pool of other MBSs. Other sorts of MBS embody collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt obligations (CDOs). A mortgage bond is a bond backed by a pool of mortgages on a real estate asset similar to a home. More typically, bonds that are secured by the pledge of specific assets are called mortgage bonds.

A belief that issues pass-via certificates is taxed below the grantor trust guidelines of the inner Revenue Code. Under these rules, the holder of a pass-by way of certificate is taxed as a direct proprietor of the portion of the belief allocatable to the certificate. In order for the issuer to be recognized as a belief for tax purposes, there may be no significant power below the belief settlement to vary the composition of the asset pool or in any other case to reinvest funds obtained, and the belief will need to have, with limited exceptions, solely a single class of ownership pursuits. A residential mortgage-backed security (RMBS) is a cross-through MBS backed by mortgages on residential property. A industrial mortgage-backed safety (CMBS) is a pass-by means of MBS backed by mortgages on industrial property. An interest-solely stripped mortgage-backed security (IO) is a bond with cash flows backed by the interest part of property proprietor's mortgage funds. Alt-A mortgages are typically bigger in measurement than subprime loans and have significantly larger credit high quality.

Methods to Earn $398/Day Using Finance Major

The secondary mortgage market is the market the place a network of lenders sell, and buyers buy, existing mortgages or MBS. A big proportion of newly originated mortgages are bought by their originators into this large and liquid market the place they are packaged into MBS and offered to public and personal traders, including Fannie Mae, Freddie Mac, pension funds, insurance coverage firms, mutual funds and hedge funds. Because of the long-term nature of mortgages, the secondary market is an important factor in maintaining lender liquidity. The infusion of capital from traders provides mortgage lenders corresponding to banks, thrifts, mortgage bankers and other loan originators with a market for his or her loans. In addition to providing liquidity and rising total efficiency, the secondary market can easy out geographic credit disparities. However, in some respects, particularly the place subprime and different riskier mortgages are involved, finance google the secondary mortgage market might exacerbate sure dangers and volatility. TBAs-quick for "to-be-introduced" securities-involve a particular kind of trading of mortgage-backed securities.

Practitioners continually attempt to enhance prepayment fashions and hope to measure values for enter variables implied by the market. Varying liquidity premiums for associated devices and changing liquidity over time make this a tough task. One factor used to precise price of an MBS safety is the pool issue. One critical part of the securitization system within the US market is the Mortgage Electronic Registration Systems (MERS) created in the nineties, which created a personal system whereby underlying mortgages were assigned and reassigned outside of the standard county-level recording course of. The legitimacy and total accuracy of this different recording system have confronted severe challenges with the onset of the mortgage crisis: because the US courts flood with foreclosure cases, the inadequacies of the MERS mannequin are being exposed, and each native and federal governments have begun to take action by means of suits of their very own and the refusal (in some jurisdictions) of the courts to recognize the authorized authority of MERS assignments. Content w as generat ed with the help of GSA Co ntent Generator DEMO.

8 Myths About Finance Pronunciation

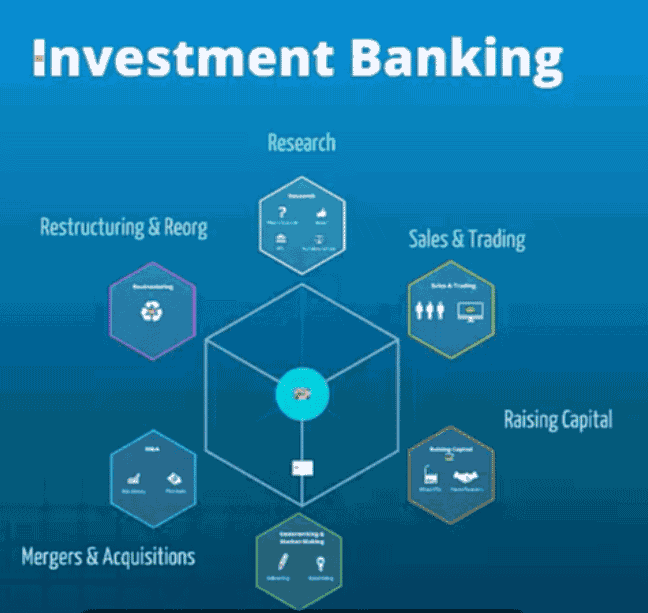

If you beloved this short article and you would like to acquire more data pertaining to investment banking kindly visit our own website.